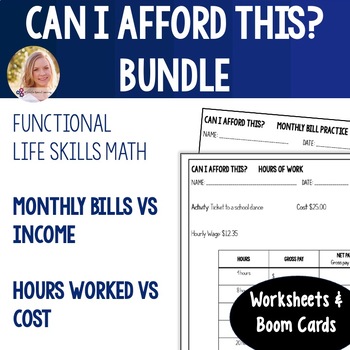

Calculating Income to Pay Bills & Afford Wants Budget Activity. Functional Math

- Zip

What educators are saying

Products in this Bundle (2)

Description

Do your students need help with functional math skills like understanding how their hourly wage job will (or will not) be able to cover their monthly expenses AND how many hours they will need to work at their hourly wage job to afford a new phone, new pair of shoes, or concert tickets?

Stretch the budgeting skill and income skills beyond restaurant orders and shopping trip costs to real-life situations, monthly bills and calculating gross and net income versus the cost of a want, and add a dash of comparison to make this even more real for students!

This BUNDLE includes functional math worksheet and Boom Card practice activity so students can calculate their monthly income and decide if it’s enough to cover their bills with this AND see how many hours they will need to work at a job to afford to buy things they want.

Calculate Income to Pay Bills

- Students will calculate the cost of all the monthly bills

- Students will calculate the amount of a paycheck

- Students will calculate how much money they will earn from paychecks in 1 month

- Students will determine if they have enough money from paychecks to cover the cost of their bills

Calculate Gross Net Income <Check out a video review of this resource on Reels!

- Students will calculate gross income based on a hourly wage for a variety of hours worked

- Students will calculate net income based on a hourly wage for a variety of hours worked

- Students will determine how many hours they will need to work to afford the cost of an activity or thing

- Students will determine if 1 shift or 1 paycheck will cover the cost

- Students will reflect to determine if the hours they would need to work at a job would be worth it

Both Resources are Perfect for:

- High school and transition age students

- Life Skills programs

- Consumer Math / Personal Finance classes

Perks:

- 10 different versions for each resource

- PDF & Boom Cards!

- NO PREP!

- Answer key included

- Blank version to create your own scenarios!

- Variety of income amounts vary (different hourly wages and pay frequency)

- Variety of bills to pay

- Design and graphics are appropriate for all ages

- Use to gather IEP goal data around functional math skills!

Make budgeting & hourly wage job income meaningful with this real life income vs monthly expenses AND real life income vs the cost of a want practice!

Follow me on Instagram and visit my Blog for more Special Education Tips and Resources!

Want exclusive freebies, notifications of sales, and new resources? JOIN MY NEWSLETTER HERE!